Feature

Big biopharma take on the ADC challenge

Antibody drug conjugates’ (ADC) development is the stand-out sector within pharma deal-making, yet persistent problems pose pervasive risks. Report by Natasha Spencer-Jolliffe.

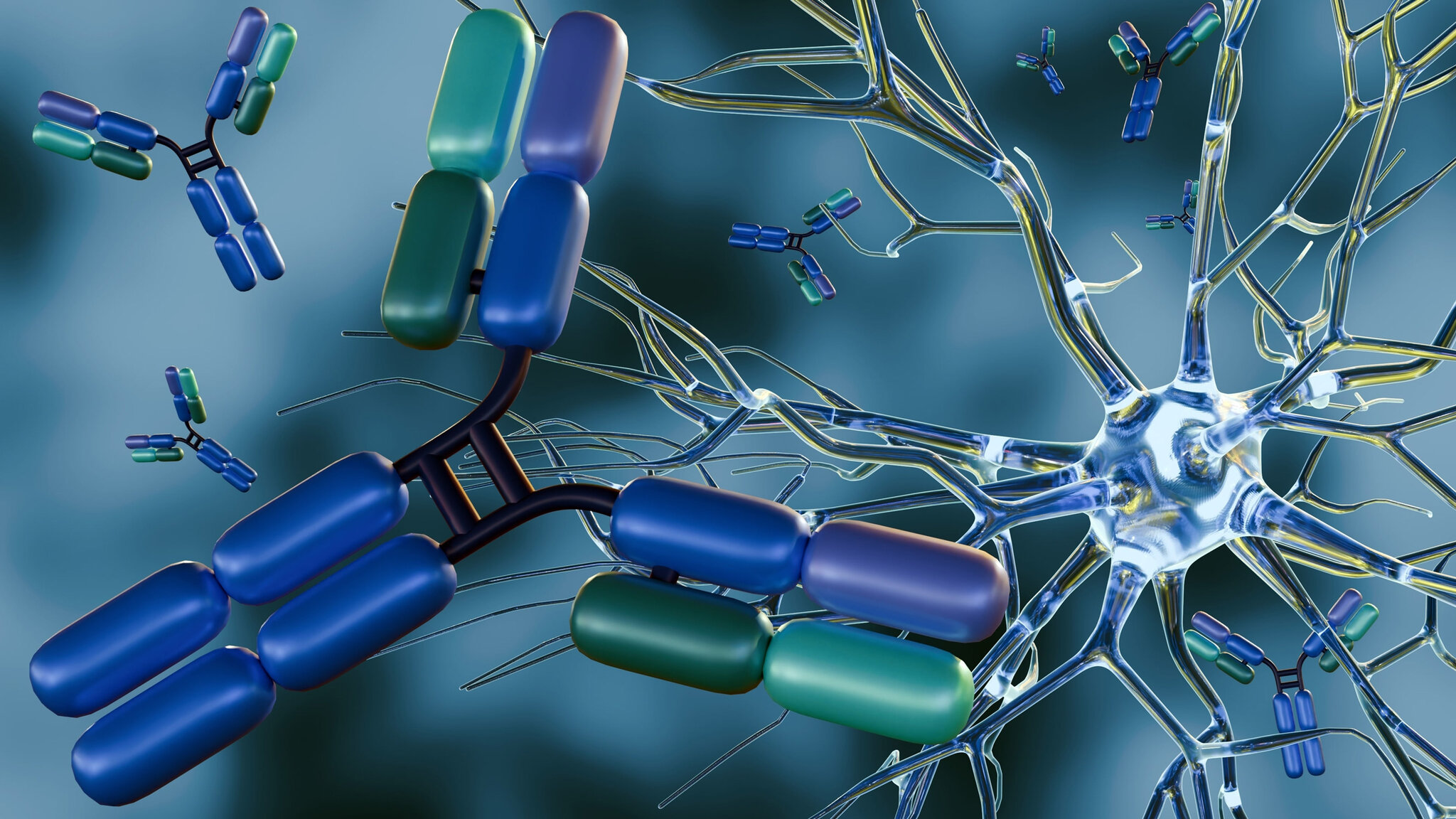

Producing ADCs involves multiple steps, including mAb production, linker-payload development, conjugation, drug manufacturing, and filling and finishing. Credit: Love Employee / Shutterstock

Antibody‑drug conjugates (ADCs) - precision-engineered molecules that deliver cytotoxic agents directly to cancer cells are fast emerging as pharma’s premier growth vehicle.

According to Global Data analysis, the global ADC market expanded from $50m in 2011 to $9.2bn by 2023, with projections indicating it could surpass $40bn by 2029. As of 2024, a growing number of approved ADCs existed globally, including 11 in the US, nine in the European Union (EU), eight in Japan and four in China. Around 100 more are currently undergoing clinical trials, at various stages.

ADCs typically consist of monoclonal antibodies (mAbs) that attach to a cytotoxic payload using a molecular linker. Their complex structure enables high efficacy and precision targeting, spurring pharmaceutical companies to bolster their R&D, testing and manufacturing efforts. ADCs are popular due to their increased ability to solubilize drugs and strengthen the payload delivered to target areas.

Finding new cancer therapy pathways

Historically rooted in oncology, ADCs are increasingly being evaluated for broader therapeutic use—including autoimmune diseases, neurology, and infectious diseases.

“ADCs represent a transformative approach in oncology, offering the ability to selectively deliver potent cytotoxic agents directly to cancer cells by targeting tumour-specific biomarkers,” a spokesperson for AbbVie told Pharmaceutical Technology Focus. “This targeted delivery has the potential to improve efficacy while minimising off-target toxicity compared to traditional chemotherapies.”

Philip Schaefer, head of business franchises and process solutions at ADC research and therapeutic developer Merck, previously confirmed that in October 2024, there were around 800 molecules in the pipeline, demonstrating the substantial momentum that ADC manufacturing is experiencing. Schaefer also said that ADC development is following an upward trajectory, with successful clinical trials leading to a significant surge in confidence among both manufacturers and investors.

Payloads, the active pharmaceutical element of the drug, are also evolving. While current ADCs utilise seeds that employ cytotoxic agents to directly kill cancer cells, newly emerging payloads, such as immune-stimulating ADCs, induce immunogenic cell death (ICD) and activate both innate and adaptive immune responses by engaging T cells that actively fight tumours.

Manufacturers are also enhancing linkers, the chemical bonds that connect the cytotoxic payload and the antibody. Non-cleavable linkers are a new category that have stable bonds and can improve plasma stability.

Investment and research spurs widespread uptake

Acquisition and alliance activity has made ADCs a focal point of high-stakes industry positioning. Pfizer’s $43bn acquisition of Seagen in late 2023, AbbVie’s $10.1bn purchase of ImmunoGen, and Merck’s up to $22bn collaboration with Daiichi Sankyo underline the high value placed on ADC prowess.

On 8 July, antibody-based therapy developer Adagene revealed it was teaming up with biotechnology company Conjugate to provide a proprietary antibody for partner companies’ bispecific ADC creation programs.

Adagene has developed its ADG126 ADC, which is currently in Phase 1b/2 clinical trials to treat advanced/metastatic solid tumours. Partnering with Conjugate, the company aims to combine a proprietary antibody with various payloads to advance ADCs and develop novel, potent, and safe varieties.

ADC developer AbbVie is exploring antibody engineering, payload development, and conjugation technology to create balanced ADCs that aim to maximise tumour activity while minimizing effects. The company has produced approved and investigational ADCs targeting biomarkers frequently overexpressed in difficult-to-treat cancers, such as c-Met, folate receptor alpha (FRα), and seizure-related homolog 6 (SEZ6). The company received its folate receptor-alpha antibody, Elahere (mirvetuximab soravtansine-gynx), as part of a$10.1 billion acquisition of ImmunoGen, which was fully approved in January 2024.

On July 22, 2025, Sutro Biopharma, an oncology company focusing on site-specific and novel-format ADCs, announced its research collaboration with the US Food and Drug Administration (FDA) to advance ADCs’ regulatory standards. “ADCs represent one of the most promising and fast-growing modalities for new biopharmaceuticals,” said Hans-Peter Gerber, Chief Scientific Officer at Sutro.

Using FDA analysis and its cell-free XpressCF technology, Sutro will produce reference materials designed to bolster analytical methods and regulatory standards for ADC manufacturing. The collaboration follows a global licensing agreement between Ipsen and Sutro, signed in April 2024, to develop ADCs, under a deal worth up to $900m.

Technical hurdles

However, struggles with ADC formulation sit alongside their potential. “The complexity of ADCs - comprising an antibody, a cytotoxic payload, and a linker—can also pose safety and tolerability challenges,” said AbbVie’s spokesperson.

Concerns are present regarding the effectiveness of ADC manufacturing. In a 2019 study, researchers stated that ADCs based therapies are still far from having high-efficient clinical outcomes. The process behind ADC manufacturing raises safety concerns, prompting further R&D to ensure that innovation within the field does not compromise the drug’s efficacy.

Producing ADCs involves multiple steps, including mAb production, linker-payload development, conjugation, drug manufacturing, and filling and finishing. Complexity within the manufacturing process and its numerous stages can add stress to the finished product. Structural changes can lead to instabilities, such as solubility issues, thermal instability, and aggregation. Defects such as these pose problems for the ADC drugs’ capabilities, shelf life, and potency.

ADC manufacturing presents significant hurdles due to the need for precise conjugation, optimising drug-to-antibody ratio, stringent quality control, and the integration of biologics and highly potent small molecules.

AbbVie spokesperson

“In addition, ADC manufacturing presents significant hurdles due to the need for precise conjugation, optimising drug-to-antibody ratio, stringent quality control, and the integration of biologics and highly potent small molecules,” AbbVie’s spokesperson added.

A research study by the British Medical Journal, published in April 2025, puts antibody immunogenicity, linker instability and inadequate control over cytotoxic agents’ release as among the key challenges in ADC development. Poor target specificity, a narrow therapeutic window and drug resistance have also been identified as key issues.

Reviewing 15 approved ADCs in cancer therapy to understand current limitations and potential future directions, the researchers highlight that ADC development is still in its infancy. While over 200 ADCs are under clinical investigation, to date, 15 have been approved for use.

According to the researchers, third- and fourth-generation ADCs have delivered improvements on problems such as stability, specificity, therapeutic index, and reduced off-target toxicity. As a result, overall, ADCs show enhanced specificity, efficacy, and safety.

However, adverse reactions and resistance to ADC drugs persist. Refinement within the R&D pipeline is therefore necessary to bolster the safety, efficacy, and specificity profiles of ADCs. “Achieving an optimal balance among these parameters during ADC design is critical for maximizing therapeutic efficacy, minimizing effects, and broadening the range of therapeutic applications,” the researchers said.

Industry moves

AstraZeneca established its ADC discovery platform in June 2024 to develop targeted cancer treatments and a variety of payloads to reflect disease biology. A month earlier, the company also announced its plans to build a $1.5bn ADC facility in Singapore, which is expected to be operational by 2029. GSK received Breakthrough Therapy Designation from the FDA in August 2024 for its B7-H3-targeted ADC, spurring forward momentum.

Smaller biotech companies are also contributing to the ADC development scene. In a deal surpassing $1bn, biotech company Day One Biopharmaceuticals emerged on the ADC market through an exclusive licensing agreement with MabCare Therapeutics to develop, manufacture and commercialize its ADC MTX-13. In April 2024, the FDA gave the green light to the investigational new drug application, known as DAY301. In May 2024, Genmab confirmed it had acquired ProfoundBio for $1.8bn.

With market research published in April 2024 suggesting that 70% of ADC projects are outsourced to Contract Development and Manufacturing Organisations (CDMOs) to reduce costs, process and project management become key hurdles that lie outside a company’s complete control. Despite outsourcing, cost may remain a problem too. Frederic Ley, CSO at Debiopharm, said that as manufacturers explore different payloads for ADC therapies, the cost associated with this innovation may be a bottleneck.