Feature

Biopharmaceutical industry cold-chain networks an innovation hotbed

With sensitive therapies on the rise, cold-chain logistics have become a strategic priority - driving innovation across packaging, monitoring, and global distribution. Gareth Macdonald reports.

Main video supplied by Lighthouse Films/Lighthouse Films via Getty Images

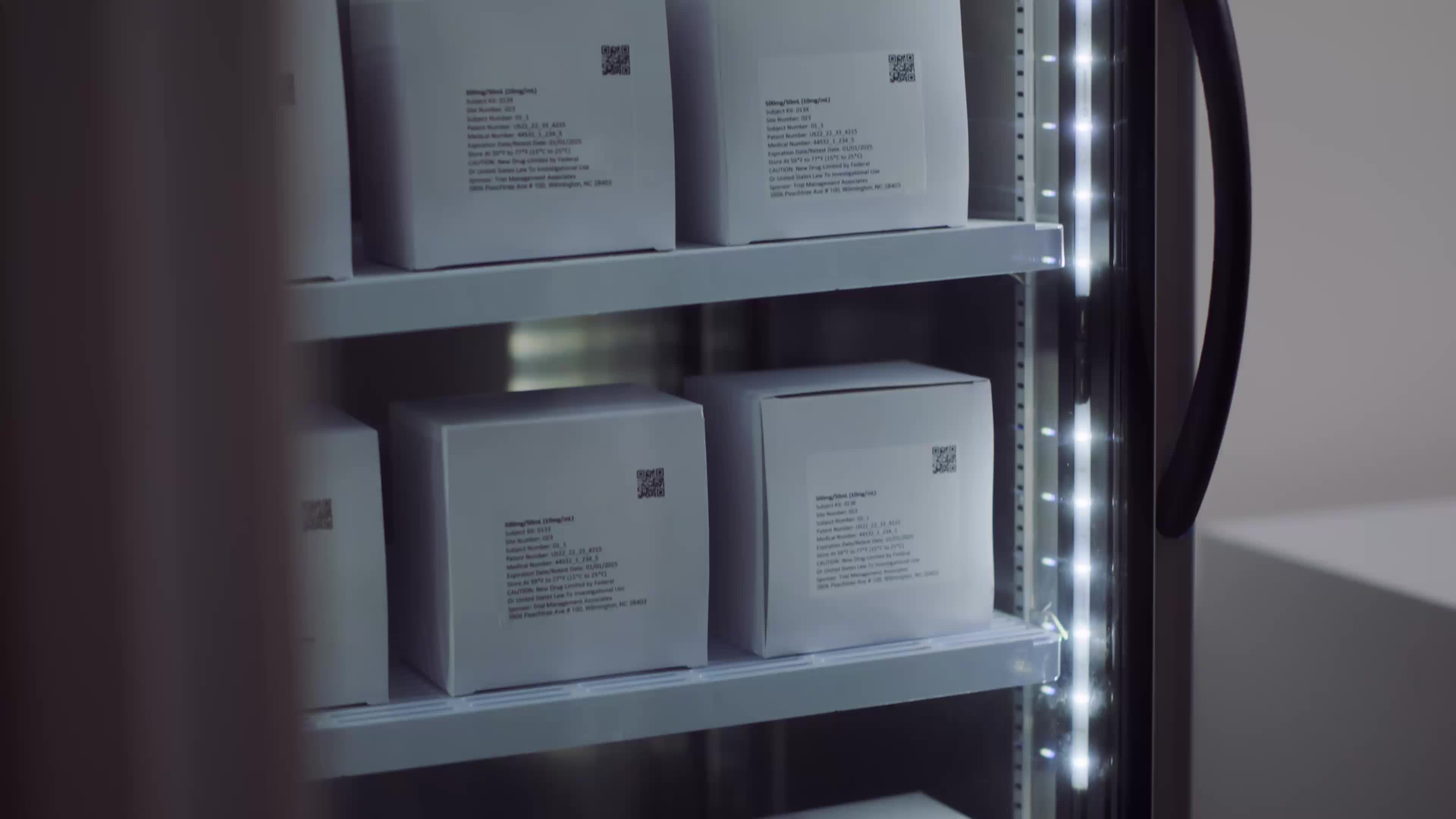

Cold-chain distribution remains a critical enabler in biopharma.

As the pipeline shifts increasingly toward temperature-sensitive modalities, maintaining product integrity across the supply chain is non-negotiable.

An evolving regulatory landscape, rising product complexity, and global distribution demands are driving innovation across the cold-chain ecosystem - from packaging and monitoring tech to specialized logistics and integrated service models.

Sensitive therapies

New therapeutic modalities have highlighted the need for more effective cold chains, notes Vishnu Kumar, assistant professor of industrial and systems engineering at Morgan State University in Maryland, US, who cites cell and gene therapies as an example.

“Cell and gene therapies (CGTs) require far more stringent cold chain conditions than protein therapeutics or small molecule drugs."

“CGTs often need cryogenic storage - sometimes –150 °C or below - to maintain cell viability, while protein therapeutics typically require refrigeration at 2–8 °C, and small molecules are generally stable at room temperature. Beyond temperature, CGTs demand precise control over timing, handling, and chain-of-identity because each product is patient-specific and highly perishable,” he told Pharma Technology Focus.

The key challenges are maintaining temperature integrity, visibility, and compliance across complex logistics networks. Even small deviations can compromise product viability.

Vishnu Kumar, Assistant Professor, Industrial and Systems Engineering, Morgan State University

Establishing a cold-chain distribution network for such products is a major undertaking, both from a technological and regulatory perspective.

“The key challenges are maintaining temperature integrity, visibility, and compliance across complex logistics networks. Even small deviations can compromise product viability,” Kumar said.

As a result, most manufacturers outsource cold-chain supply chain development to experts or, at the very least, source specialist technologies from suppliers. And this demand has become a major innovation driver.

“Logistics providers are increasingly adopting IoT-based temperature monitoring, GPS-enabled traceability, and blockchain systems to enhance transparency and control. Portable cryogenic containers, modular cold rooms, and energy-efficient storage units are expanding ultra-cold capacity in low-resource settings. These innovations improve product quality while reducing operational costs,” said Kumar.

Innovation

The need for cost effective cold-chains is also fuelling innovation according to Kumar, who recently co-authored a paper looking at how biopharmaceutical companies are using novel technologies to minimise spending.

“Smaller providers often lack the resources to deploy advanced monitoring systems, a gap my paper addresses with a low-cost IoT solution using Raspberry Pi and sensors. Affordable real-time monitoring can help these players strengthen reliability and integrate into the broader CGT supply chain,” he said.

Likewise, biopharmaceutical industry efforts to reach new potential markets are also driving innovation in cold-chain distribution technologies.

“Emerging markets often lack reliable cold chain infrastructure: from validated ultra-cold storage to temperature-controlled transport and continuous data monitoring. This disparity limits access to advanced biologics and CGTs.

“Our research highlights scalable, cost-effective IoT frameworks as a practical way to strengthen cold chain capacity in resource-constrained environments. Leveraging affordable sensors and mobile-based monitoring can help bridge infrastructure gaps without large capital investments,” Kumar said.

And looking forward, Kumar predicts that technological innovation in the cold chain logistics space will accelerate as biopharmaceutical companies and their contractors embrace the predictive capabilities of artificial intelligence.

“AI and automation are transforming cold chain logistics through predictive maintenance, anomaly detection in temperature data, and optimised routing. In CGT supply chains, AI can forecast demand, automate chain-of-custody documentation, and reduce human error, thereby improving both efficiency and reliability across the network.”

Macro economics

Macro-economic trends also impact the cold-chain logistics technology and supply sector. When market conditions change, there are often new opportunities.

Current uncertainty in the US in relation to tariffs is an example. Since January, the US Government has sought to use levies on various imports – including medicines – to encourage industries to manufacture products in the country.

Indeed, as recently as last month, President Donald Trump announced that 100% tariffs would be imposed on patented pharmaceutical products from October 1, unless the manufacturer builds a plant in the US.

Over the same period, several large biopharmaceutical companies – Genentech, GSK and Eli Lilly – have announced investments in US manufacturing, although none have mentioned the tariffs as an explicit motivation.

But irrespective of why they are doing it, these investments will create opportunities for the cold-chain industry according to services firm, Euro-American Worldwide Logistics, which wrote about the dynamics in a recent blog post.

“For the logistics sector, these investments signal a surge in demand for specialized transportation, warehousing, and compliance services.

“This shift reinforces the need for logistics partners that can provide GMP-compliant warehousing, advanced temperature control - 2-8°C and 15-25°C- customs brokerage expertise, and integrated international freight forwarding,” the firm wrote.

COVID-19

Covid-19 also had a lasting impact on biopharmaceutical industry cold-chains, primarily, because the mRNA-based vaccines used to slow the spread of the disease required ultra-low temperature freezers for storage.

According to Kumar the pandemic exposed capacity gaps but also drove major innovation. Demand for temperature-controlled logistics surged, highlighting weaknesses in storage, monitoring, and last-mile delivery.

“In response, the industry rapidly adopted digital tracking - such as those mentioned in our paper - real-time visibility tools, and new distribution models, turning cold chain logistics from a support function into a strategic priority,” he said.

And in the years since, efforts to bolster biopharma cold-chains have continued, albeit the focus has shifted to the development of networks that will be more robust during future health emergencies.

“The key lesson is that resilience depends on visibility and flexibility. Investments in IoT monitoring, AI/ML and predictive analytics, and regionalised networks have made systems far more agile,” said Kumar.

“Collaboration across manufacturers, logistics providers, and governments has also improved. Overall, biopharma cold chains are now more connected, data-driven, and better prepared for future emergencies.”