DEALS ANALYSIS

Deals activity: South and Central America deals increase; grants up

Powered by

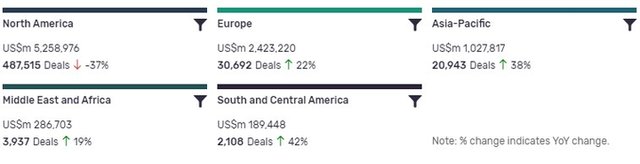

Deals activity by geography

Pharma industry deals, as captured by GlobalData’s Pharmaceuticals Intelligence Centre, are up year-on-year (YoY) across all regions.

North America is leading in terms of deal value, but recorded the lowest YoY growth in deals volume at -37%. Asia-Pacific, ranking third in terms of deal value, has seen the second largest YoY change, with deal volumes increasing by 38%.

The volume of deals recorded by GlobalData also increased YoY in South and Central America (42%), Europe (22%) and Middle East and Africa (19%).

Deals activity by type

| Deal type | Total deal value (US$m) | Total deal count | YoY change (volume) |

| Partnership | 468,958 | 17,897 | 6 |

| Venture Financing | 222,897 | 17,882 | 77 |

| Contract Service Agreement | 1,859 | 17,969 | 442 |

| Equity Offering | 877,047 | 16,058 | 154 |

| Licensing Agreement | 703,921 | 13,473 | 51 |

| Grant | 121,011 | 418,277 | 434 |

| Acquisition | 3,669,901 | 10,697 | -12 |

| Debt Offering | 1,758,440 | 7,831 | 19 |

| Asset Transaction | 429,705 | 6,047 | -49 |

| Private Equity | 498,605 | 2,477 | 0 |

| Merger | 178,638 | 672 | 2909 |

A breakdown of deals by type and volume shows a 2909% growth in mergers YoY, while acquisitions are down 12%, partnerships grew with 6% change YoY and asset transactions are down -49%. Financing deals have increased across some types, with venture financing up 77% YoY, equity offerings up 154% and debt offerings up 19%.

Private equity, however, has seen 0% growth in number of deals YoY, while the number of grants recorded is up 434%. The number of contract service agreements recorded by GlobalData is up 442% YoY.

Deals activity by therapy area

The most notable development apparent in GlobalData’s analysis of pharma industry deals by therapy area is the increase of deals in the field of infectious diseases. After remaining relatively steady over the past ten years, the number of recorded deals in infectious diseases increased significantly in 2020 to date, most likely due to the impact of the Covid-19 pandemic on activity in the sector.

Note: All numbers as of 18 January 2021. Deals captured by GlobalData cover M&As, strategic alliances, various types of financing and contract service agreements.

For more insight and data, visit GlobalData's Pharmaceuticals Intelligence Centre.

Latest deals in brief

Thermo Fisher Scientific acquires Novasep’s Henogen for $874.5m

Thermo Fisher Scientific has acquired Novasep’s viral vector manufacturing business in Belgium, Henogen, for about €725m ($874.5m) in cash. Founded 20 years ago, Henogen offers biotechnology firms, as well as biopharma customers contract manufacturing services for vaccines and therapies.

NewAmsterdam Pharma raises $196m through Series A funding round

Clinical stage company NewAmsterdam Pharma has raised $196m (€160m) through Series A funding round to support the full Phase III development of its ApoB and LDL-c lowering small molecule drug, obicetrapib. The drug, a cholesteryl ester transfer protein inhibitor, is being developed for patients not well-controlled on statins.

Boehringer enters into cancer drug development deal with Enara Bio

Boehringer Ingelheim has entered into a strategic collaboration and licensing agreement with Enara Bio to research and develop new targeted cancer immunotherapies. Enara Bio’s Dark Antigen Platform Technology will be utilised for discovering and validating new Dark Antigens in up to three types in lung and gastrointestinal cancers.

Humanigen and EVERSANA collaborate for Covid-19 drug commercialisation

Clinical-stage biopharmaceutical company Humanigen and EVERSANA have entered a partnership to make available the former’s lead drug candidate, lenzilumab, to hospitalised and hypoxic Covid-19 patients on obtaining approval. The company is anticipating an Emergency Use Authorisation issued by the US Food and Drug Administration, as well as a BLA.

Sanofi to acquire clinical-stage biopharma firm Kymab for $1.45bn

Sanofi has signed an agreement to acquire clinical-stage biopharmaceutical company Kymab for an upfront payment of about $1.1bn in cash. The deal also includes payment of up to $350m on achieving particular milestones.

Merck to acquire German contract development company AmpTec

Merck has announced the acquisition of Germany-based, mRNA contract development and manufacturing organisation AmpTec. The deal will enhance Merck’s expertise in developing and manufacturing mRNA for its customers for use in vaccines, treatments and diagnostics applicable in Covid-19 and various other diseases.