DEALS ANALYSIS

Deals activity: YoY deal decline continues; acquisitions lead deals volume

Powered by

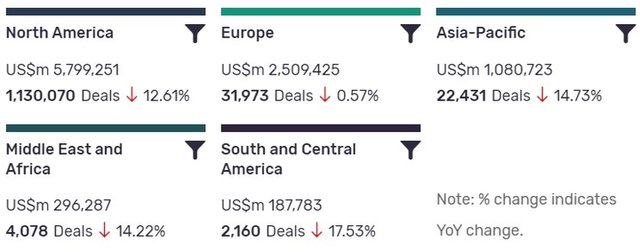

Deals activity by geography

Pharma industry deals, as captured by GlobalData’s Pharmaceuticals Intelligence Centre, are down year-on-year (YoY) across all regions.

North America is leading in terms of deal value, but recorded a YoY decline in deals volume at -12.61%. South and Central America, ranking last in terms of deal value, has also seen notable YoY change, with deal volumes decreasing by -17.53%.

The volume of deals recorded by GlobalData also decreased YoY in Asia-Pacific (-14.73%), Europe (-0.57%) and Middle East and Africa (-14.22%).

Deals activity by type

| Deal type | Total deal value (US$m) | Total deal count | YoY change (volume) |

| Partnership | 492,069 | 18,675 | 2.23 |

| Venture Financing | 260,006 | 19,368 | 113.26 |

| Contract Service Agreement | 1,860 | 19,173 | -49.18 |

| Equity Offering | 976,401 | 17,078 | 39.93 |

| Licensing Agreement | 754,218 | 14,047 | 23.65 |

| Grant | 400,549 | 1,057,362 | 18.80 |

| Acquisition | 3,757,151 | 11,117 | 71.14 |

| Debt Offering | 1,794,405 | 7,955 | -45.30 |

| Asset Transaction | 439,841 | 6,153 | -41.19 |

| Private Equity | 569,020 | 2,673 | 270.20 |

| Merger | 175,886 | 720 | 694.15 |

A breakdown of deals by type and volume shows a 694.15% growth in mergers YoY, while acquisitions are up 71.14%, partnerships increased with 2.23% change YoY and asset transactions are down -41.19%. Financing deals have increased across some types, with venture financing up 113.26% YoY, equity offerings up 39.93%, but debt offerings down -45.30%.

Private equity has seen 270.20% growth in number of deals YoY, while the number of grants recorded is up 18.80%. The number of contract service agreements recorded by GlobalData has declined -49.18% YoY.

Deals activity by therapy area

The most notable development apparent in GlobalData’s analysis of pharma industry deals by therapy area is the increase of deals in the field of oncology. After recording 3,193 deals in 2020, the sector has witnessed 1,476 deals to date in 2021.

Note: All numbers as of 20 July 2021. Deals captured by GlobalData cover M&As, strategic alliances, various types of financing and contract service agreements.

For more insight and data, visit GlobalData's Pharmaceuticals Intelligence Centre.

Latest deals in brief

Partners Group to acquire Pharmathen from BC Partners for $1.9bn

Partners Group has agreed to acquire a European pharmaceutical company Pharmathen from the international investment firm BC Partners for an enterprise value of approximately $1.9bn (€1.6bn). Established in 1969, Pharmathen is a contract development and manufacturing organisation that focuses on drug delivery technologies for complex generic pharma products. Partners Group is acquiring Pharmathen on behalf of its clients.

Ipsen and IRLAB sign $363m deal for Parkinson’s disease therapy

Ipsen has entered a licensing agreement with IRLAB to obtain exclusive global development and commercial rights for the latter’s investigational therapy, mesdopetam. An oral dopamine D3-receptor antagonist, mesdopetam is being developed for preventing and treating levodopa-induced dyskinesias.

Kriya raises $100m in Series B funding round to develop gene therapies

Kriya Therapeutics has raised $100m in Series B funding round to advance its platform for designing, developing and producing next-generation gene therapies. Patient Square Capital led the funding round with new investors Woodline Partners, CAM Capital, Hongkou and Alumni Ventures, among others, taking part.

Kintor partners with Fosun to market Covid-19 therapy in India and Africa

Kintor Pharmaceutical has signed a licensing agreement with Shanghai Fosun Pharmaceutical Development to market its drug, proxalutamide, for Covid-19 in India and 28 African countries. A nonsteroidal anti-androgen or an androgen receptor antagonist, proxalutamide is being developed for the potential treatment of Covid-19, as well as prostate and breast cancers.

Novo Nordisk to acquire Prothena’s ATTR amyloidosis unit for up to $1.2bn

Novo Nordisk has signed a definitive purchase agreement to acquire Prothena’s investigational drug, PRX004, as well as a wider ATTR amyloidosis programme for a total of up to $1.2bn. A humanised monoclonal antibody, PRX004 can potentially reduce the amyloid deposits linked to the disease pathology of ATTR amyloidosis.

Philip Morris agrees to acquire Vectura for $1.45bn

Philip Morris International has made an offer to acquire a contract development and manufacturing organisation Vectura Group for approximately $1.45bn (£1.045bn) to boost its product pipeline development expertise in inhaled treatments.