The competitive landscape of neoantigen-targeting therapeutics in oncology

New approaches to neoantigen therapy aim to predict the most important tumour antigens and formulate personalised vaccines against them.

Finding a way to target tumour antigens to promote an anti-tumour immune response had been a research goal for decades. Such efforts culminated in the US Food and Drug Administration’s (FDA) approval of the first therapeutic vaccine in 2010, Dendreon Pharmaceuticals’ Provenge (sipuleucel-T) for prostate cancer.

While Provenge seeks to stimulate the immune system against a single, prostate cancer-specific tumour antigen, new approaches aim to predict the most important tumour antigens and formulate a personalised vaccine against them. These include cell-based vaccines and peptide/nucleic acid vaccines.

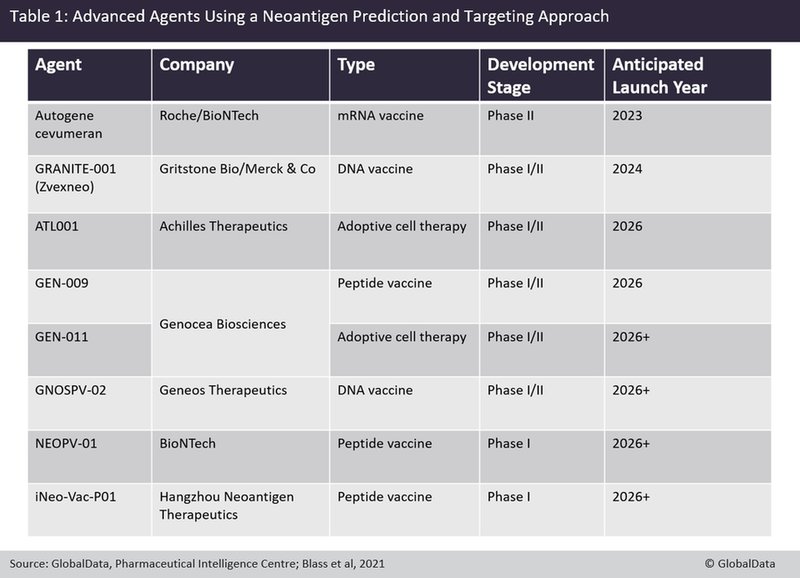

The leading companies in the space are Achilles Therapeutics, Roche, BioNTech, Merck and Co, Genocea Biosciences, Geneos Therapeutics, Hangzhou Neoantigen Therapeutics and Gritstone Bio.

Previous academic work in melanoma patients has shown that dendritic cell vaccines against neoantigens can promote T-cell responses, but has not shown whether the vaccines exert significant anti-tumour activity.

Other academic work with peptide neoantigen vaccines has suggested that in the adjuvant setting, neoantigen vaccines may delay tumour recurrence.

Taking the neoantigen approach a step further, a new biotech company is seeking to eliminate all cancer cells by identifying clonal neoantigens. Clonal neoantigens are believed to be present in all tumour cells and can be targeted with selected tumour-infiltrating cells, then cultured and enriched.

While this approach is still in a very early stage, the leading company in this space is Achilles Therapeutics (Achilles), with its ATL001 programme. One common factor in the above approaches is a need for a proprietary platform that combines bioinformatics, genomics and proteomics to identify or predict neoantigens and formulate a vaccine or adoptive cell therapy.

Some of the most advanced molecules in the neoantigen-targeting space can be found in Table 1. Of these, three are nucleic acid-based vaccines, three are peptide vaccines and two are adoptive cell therapies. Of the adoptive cell therapies, only one is against clonal neoantigens. Clinical trial data for any of them are either preliminary or not yet released.

The most advanced data come from Hangzhou Neoantigen Therapeutics’ Phase I trial (NCT03662815) for its iNeo-Vac-P01 programme. In a mixed tumour cohort with 22 patients, there was a disease control rate of 71.4% at a median progression-free survival of 4.6 months.

Of note is the fact there were only two Grade 3/4 adverse events in the entire cohort, specifically allergic reactions, thus bolstering the hypothesis that neoantigen vaccines can be exceptionally well-tolerated.

The four molecules expected to launch first are Roche’s autogene cevumeran, Gritstone Bio’s GRANITE-001, Achilles’ ATL001 and Genocea Biosciences’ GEN-009. These have combined peak forecast sales of more than $1bn, according to GlobalData’s estimates.

The field is, however, in its infancy, and clinical validation of any of the approaches will greatly expand the total market value. A potential positive efficacy signal for Achilles upon the first clinical trial readout could be enough to kickstart the creation of a whole new class of clonal neoantigen therapeutics and lead to the formation of many startup companies with innovative approaches.

For pharmaceutical industry data, comment and analysis, visit GlobalData's Pharmaceuticals Intelligence Centre.

Market Insight from